According to the reports of the financial market for 2023, the global foreign exchange market was valued at US$ 805 billion in 2023. That’s a huge amount to look at based on the financial level. And no wonder people are looking to learn how to become a forex broker and grab all the trends, deals, and profits in foreign exchange currency.

Stock trading and foreign exchange market trends offer money-making opportunities to all people if the strategies are built and implemented accurately. Especially in India, forex trading is different from regular trading and is a profitable business due to the large, growing economic rate of the country. Hence, the answer to how to become a forex broker in India is simple and gives a heavy profit.

The given article is a comprehensive guide that teaches you how to become a forex broker in India, including all the required strategies, methods, qualifications, marketing, and finding the best forex brokers in India. In this guide, we will also discuss how to choose a forex exchange firm, whether forex VPS hosting services are required or not, and how to establish a forex business, attract clients, and run a successful pact as a forex broker in India. So without wasting much time, let’s get into the process of establishing a successful forex trading business and becoming a forex broker.

Let’s begin with:

“What is a Forex Broker?”

Forex trading is the practice of buying and selling foreign currency and the aim is to maximize profit margins with the help of fluctuations in the currencies of different countries. Now, consider a forex broker as a financial services company. This company acts as an intermediary between buyers and sellers of foreign currencies.

A forex broker provides a platform for traders where they are allowed to buy and sell currencies at market prices. Profit margins that traders gain during the forex market determine the overall turnover. To give you a brief idea of the global market for foreign exchange, about trillions of dollars are traded in a single day.

Different Forex Broker Business Models Operating In India

Several forex brokerage business models are used by Indian forex brokers. The top business models are as follows:

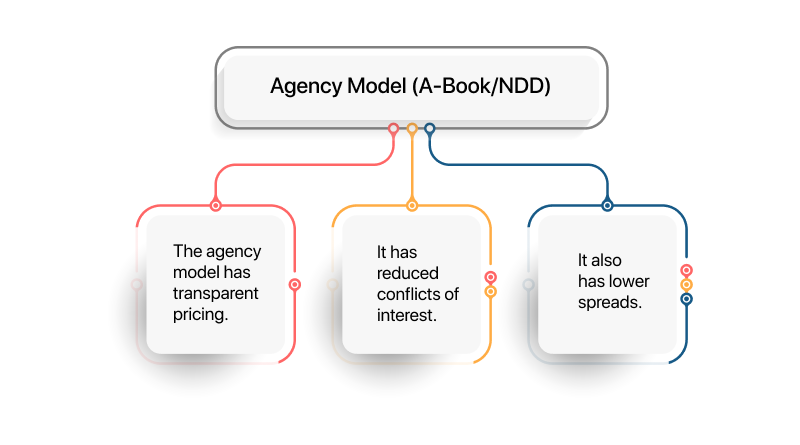

1. Agency Model (A-Book/NDD)

The agency model, also known as the A-book model, enacts the broker as an agent for its clients. Here, the broker matches the orders directly with liquidity providers (LPs) in the interbank market.

Features:

- The agency model has transparent pricing.

- It has reduced conflicts of interest.

- It also has lower spreads.

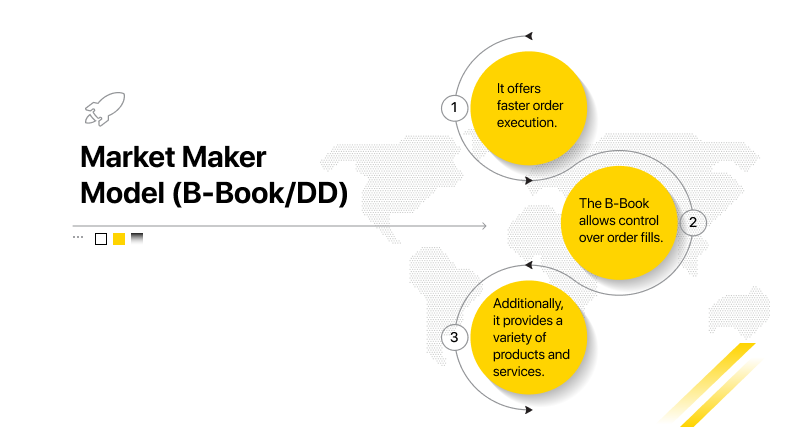

2. Market Maker Model (B-Book/DD)

The market maker model or B-Book model involves the broker taking the opposite side of the trade from its clients.

Features:

- It offers faster order execution.

- The B-Book allows control over order fills.

- Additionally, it provides a variety of products and services.

3. Hybrid Model

As the name suggests, a hybrid model is a combination of both the A-Book and B-Book models. In this model, the broker combines elements of both the agency and market maker models.

Features:

- It offers the benefits of both models.

- It can be tailored to the specific needs of the broker’s clients.

4. White Label Model

White-label in the foreign exchange market establishes authority, reliability, and trust. In this model, a white-label provider licenses its trading platform and other technology to a business that wants to offer forex trading services under its own brand.

Features

- It is an easier and faster way to enter the forex market.

- It can also leverage the provider’s technology and expertise.

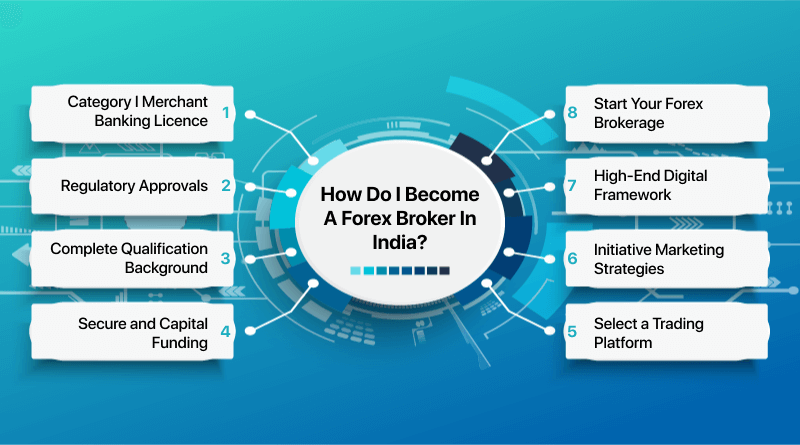

How Do I Become A Forex Broker In India?

Forex trading in India is a game of risk and requires very tentative attention to master. Forex trading in India is handled by the Reserved Bank of India, which allows traders to buy or sell stocks on the NSE (National Stock Exchange), BSE (Bombay Stock Exchange), and MSE (Metropolitan Stock Exchange).

To make transactions safe and secure, the Indian government has implemented SEBI (Securities and Exchange Board of India).

Now that you know a short brief about forex trading handling and management, let’s move towards a step-by-step guide on how to become a forex broker in India with easy and safe methods.

1. Category I Merchant Banking Licence

To start as a forex broker, the foremost important step is to obtain a Category I Merchant Banking license. This license certifies that, as a forex broker, you are familiar with the guidelines, rules, and restrictions laid by SEBI and thoroughly understand all of them.

2. Regulatory Approvals

After getting a Category I Merchant Banking License, you need to have approvals from various sections to start your journey as a forex broker. Comply with all regulatory requirements with a comprehensive application. A rigorous SEBI review will then be conducted on this application, scrutinizing each document for approval.

3. Complete Qualification Background

To become a forex broker in India, you don’t need any specific degree; however, your educational qualification certificates should show that you have a strong grasp of financial statements, economics, and international trade patterns. Moreover, pursue courses that aid in developing analytical skills, critical thinking processes, understanding charts, trading platforms, and technical skills.

4. Secure and Capital Funding

SEBI has laid down capital guidelines along with other details. This indicates that, as a forex broker in India, you need to maintain a satisfactory capital investment for the initial startup of your forex trading business. To meet the requirement, you have options like self-funding, attracting investors, or partnering with existing brokers.

5. Select a Trading Platform

You need to look for the best forex trading platform in India. The forex trading software you choose should be able to provide you with a reliable and user-friendly trading experience. It should collaborate easily with factors such as liquidity, security, trading tools, and integration to offer a smoother experience.

6. Initiative Marketing Strategies

To become a forex broker, you also need a strong understanding of your target audience, potential conversion points, and USPs of the market. This knowledge leads to the creation of effective marketing strategies to boost revenue growth seamlessly.

7. High-End Digital Framework

As a forex broker, you need to have a strong and reliable digital service that can efficiently handle your business transactions and data. You need specialized forex VPS hosting servers, data centers, and a best-in-class network structure. These resources ensure that your trading volumes run smoothly and mitigate the risks of network interruptions. Hence, invest in the best hosting providers that will provide your extended support.

8. Start Your Forex Brokerage

Once you have all the above-mentioned resources and requirements fulfilled, you can launch yourself as a forex broker in India and start earning forex brokerage. Keep up-to-date with market trends, technology, and innovations.

Important Skills Required To Become A Forex Broker In India

How do I become a forex broker? To start your forex business, you need to achieve certain skills that enhance the brokerage market in India.

- Financial And Analytical skills

- Quantitative And Analytical Skills

- Technical Skills

- Regulatory And Compliance Skills

- Communication And Business Skills

- Problem-Solving Skills

- Adaptability And Learning Agility

Educational Fields to Choose

As a forex broker, you don’t have any certified degree or stream that teaches foreign exchange. However, people with educational backgrounds and streams like commerce or finance find it helpful. So if you are looking to get a college degree, consider streams like business, finance, or economics. Degrees from such streams increase your chances of getting hired.

As a forex broker, get yourself a degree such as:

- Finance

- Business Administration

- Investment management

- Economics

- Statistics

- Computer Science

- Applied Mathematics

- Data Analytics

How do I get a Forex broker license?

Obtaining a forex broker license involves a multi-step process and specific documents. You need to ensure that you have the correct information to mitigate all the spelling errors and minor mistakes. The steps are as follows:

- The licensing procedure varies from country to country; choose your jurisdiction and follow the given procedure.

- Once your jurisdiction is specified, research the license requirements.

- Collect all the mentioned documents, including business licenses, application forms, KYC documents, proof of capital, and much more.

- Submit your application form and the required fees to the official forex department of the jurisdiction.

- After the submission, wait until your application is reviewed and passed. Once it clears the review process, you will be granted the forex broker license.

Advantages of Being a Forex Broker in India

- Forex brokers work in an international financial market where trillions of dollars are exchanged daily, which means they have a higher scope for gaining huge profits.

- Forex brokers has a scalable business option; you can start with a smaller investment and gradually increase as per the profits gained.

- The Indian forex market has the highest transactional activity, so offering forex brokerage services in India ensures potential profits and a large client base.

- Forex brokers require low investment as compared to other countries; therefore, forex brokers can offer competitive rates and attract clients.

Top Forex Brokers FAQs

What is a forex broker?

A forex broker is a mediator between forex traders and the interbank market. Forex brokers offer financial services and a platform where buyers and sellers perform foreign currency trades.

What does a forex broker do?

Apart from being a mediator and providing a platform, forex brokers also help in executing foreign exchange orders, tracking trade performance, providing direct market access (DMA), quoting currency pair prices, and providing leverage to buyers and sellers to maximize profit.

How to start a forex business from scratch?

To build your forex business from scratch, you need to have good control over the trading patterns of the foreign exchange. In the above article, I have mentioned a step-by-step guide where you can start your forex business easily and effortlessly.

Who regulates forex trading in India?

Forex trading in India deals with the hefty transaction orders carried out daily; thus, to mitigate financial losses and scams or frauds, the government of India takes control over the regulation of forex trading. The trades are regulated by two main entities: the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). The primary hold over the monetary system is held by the RBI, while SEBI holds the rules and regulations process.

How much does it cost to start forex trading in India?

The cost of starting forex trading in India can vary based on several factors. However, an estimation of the approximate cost to start forex trading in India is around ₹15000 to ₹25000. This includes brokerage fees, minimum deposit, platform fees, margin requirements, and education and training fees. However, this is just an estimation; the actual cost may differ from this.

When you are looking for how to become a forex broker, know that launching a forex brokerage business requires constant adaptation to the foreign exchange market. The currency fluctuations and ever-changing conditions increase the profit potential.

The competition for how to become a forex broker in India is high due to the volume of funds traded. The competition among the Indian forex brokers is extremely fierce. A beginner needs to have a strategic plan from the outset to get a hold of the market.

Providing high-quality customer service that responds to inquiries promptly can serve as a powerful marketing tool and enhance your reputation as a reliable forex brokerage firm. Services should also excel in various areas, including risk management, customer service, trading desk operations, compliance, and finance.

Thus, a collaborative strategy, knowledge about forex trades, and dedication to the services can simplify your process of becoming a forex broker in India.